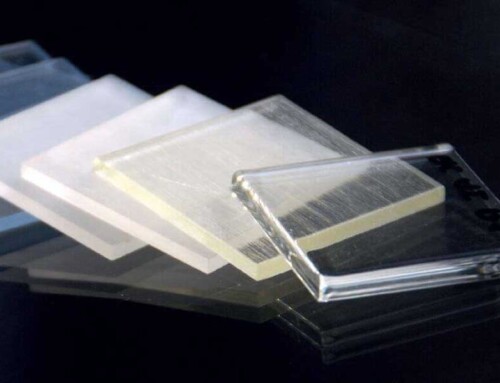

The price of materials changes almost constantly-in a single day, the cost of resin can rise and fall many times. With so many unstable factors in the market, it is increasingly difficult for plastic manufacturers and consumers to predict prices.

Price fluctuations greatly affect the financial results of your business. This may cause your profit margins to become narrower and narrower, leading to a greater risk of loss. However, the factors that affect resin prices can provide some predictability for your business’s raw material costs. This knowledge can help you better manage your operations and make more informed buying decisions.

1. Upstream Assets and Raw Materials

Upstream assets are those used by plastic refineries and manufacturers to produce crude oil and natural gas. These are market fundamental factors that are affected by the country’s and company’s mining rights, physical extraction and refining processes. At every stage of the plastic resin manufacturing process—from oil and gas to the final product—there are regulatory, technical, and economic factors that affect the entire value chain.

The more restrictions there are, the more expensive the resin will be. Since the establishment of this market, the United States has been a strong competitor, with multiple crude oils and natural gas collection and refining facilities around the world.

On the other hand, raw materials refer to materials that are converted into plastic resins. These are crude oil, natural gas, and additives used to make different types of resins. The cost of these materials is affected by availability and market demand. When these materials are in short supply, the production of resin becomes more expensive. Therefore, the manufacturer may sell the resin at a higher price to recover the cost from the customer.

2. In Stock

The inventory of plastic resins will also affect their market prices. If plastic manufacturers have surplus plastics (such as polyethene), they may provide resins at discounted prices to reduce inventory costs.

At the same time, low supply tends to cause high demand, which in turn pushes up resin prices. Most manufacturers will try to make their product pricing competitive at any given time to meet supply and demand.

Generally speaking, American manufacturers can keep resin prices at a low level because they have a large amount of crude oil and natural gas extraction and refining capabilities. Since the beginning of trade, the United States has been at the top of the global market. Therefore, the United States has more control over resin pricing than most other countries.

On the other hand, in the past ten years, China has been able to build a strong oil import and refining industry. China’s goal is to increase production capacity by establishing several new factories in India and the Middle East. By doing so, they are becoming a growing force in the international plastic resin market-but they have not surpassed the United States to become the world’s largest plastic resin producer.

3. Industry Trends

Trends between different industries also affect industry prices. In the United States, the demand for pre-packaged food is growing, and therefore, the demand for the plastic resin is also increasing. If resin production capacity is low, or the inventory of these factories cannot meet demand, this may cause prices to rise.

However, this growing demand can also further promote industry growth, allowing the country to build more resin refining and production facilities. The trend from rigid product packaging to flexible plastic packaging is also growing.

This is because the resin used in flexible packaging tends to be cheaper. This trend may cause many factories to focus on the acquisition and production of specific resins. As more equipment focuses on these materials, these resins become cheaper for consumers because producers create a surplus.

4. Labour and Production

The production of plastic resin also differs from country to country. U.S. facilities usually use natural gas as a feedstock. For polypropylene (PP), US manufacturers use crude oil.

In other countries such as China, oil refineries mainly use crude oil. This means that when crude oil prices rise, plastic resins made in the United States can be sold at lower prices. On the other hand, when the supply of natural gas is insufficient, plastic resins made in China are priced more competitively than American products. Another factor that affects resin pricing is the availability and cost of labour.

In resin production, your factory will need talented employees to create high-quality end-use products. When it comes to this factor, the labour cost of American plastic resin manufacturers is usually higher than that of using plastic resin from China.

This is because China’s labour force is abundant and cheap. Labour wages are cheaper, a large number of well-trained labour is available at all times, and there are fewer health and safety regulations to consider. However, the use of American labour has the benefit of additional policies and regulations to ensure that high-quality products can meet demanding standards, such as those used in the medical or automotive industries.

5. Adjustment of Production Capacity

The industry’s ability to meet demand will also affect the price of plastic resins. This includes production, transportation, and manufacturing processes.

For example, if there is a large demand for polyethene resin, but many oil refineries postpone the delivery of raw materials due to bad weather, the final product prices will increase.

The US market has a huge plastic resin production capacity, but this capacity is severely affected by external forces such as the ongoing COVID-19 pandemic. Last year, many facilities in the United States have been closed due to financial and logistical problems caused by the virus.

Another factor affecting US production capacity is the promotion of biofuels, which has led some companies to reuse their facilities and stop producing resin. Too many facilities will also have a negative impact on prices. This happens when production exceeds demand, leading to a surplus.

The Chinese market is like this. The production capacity of the new refining and manufacturing plants has exceeded the expected demand growth. If market demand maintains the expected trend in the next few years, these factories in China may be closed.

6. Policy and Geopolitical Events

Policies and events that affect the demand for plastic end products can increase or decrease the demand for resin. These changes can be felt both locally and internationally.

For example, if the United States promotes alternatives to plastics such as biodegradable packaging-this will reduce the demand for disposable packaging made of polyethene resin.

On the other hand, events that promote countries to produce more disposable plastics for hygienic reasons will greatly increase the demand for plastic resins. A current geopolitical event is a pandemic. From the medical industry to ordinary consumers, the demand for personal protective equipment such as masks, face masks and disposable gloves continues.

Certain policies and events have caused the price of plastic resin to soar due to high demand. If the plastic resin industry has low inventory and production capacity, the price will be particularly high. Conversely, the government and the shift to alternative products will also lead to a decline in demand, forcing manufacturers to price their resins competitively in order to reduce losses.

7. Conclusion

Considering the many factors that affect resin pricing, it is difficult for many people to accurately predict pricing trends. However, understanding possible changes can help you better deal with the market and its associated risks, giving you a clearer image of the overall management plan.

If your business is a customer of plastic resin, investing in a reliable partnership with an experienced manufacturer can help you keep up with price fluctuations and unexpected costs. With a partner like Holly, you can safely supply high-quality resin at the best price you can afford, despite the unpredictable market.

Leave A Comment